Processing payment is simple and easy once a payment method has been saved on file to a client profile.

- When the client is ready to pay, simply click Record Payment like you normally would

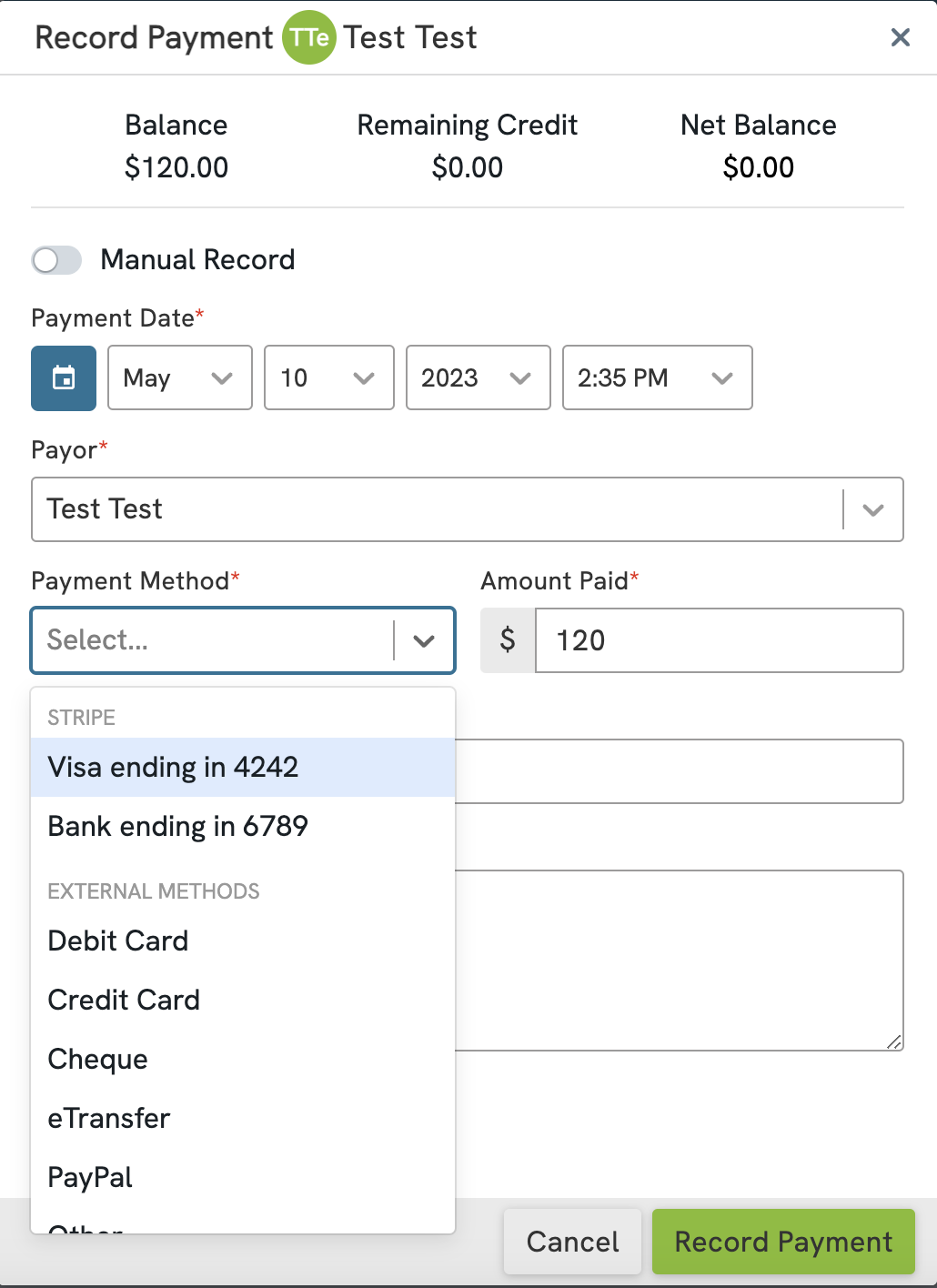

- Next, click on the Payment Methods dropdown menu and you will see any credit cards or bank accounts that have been saved to the client’s record listed here in the Stripe section:

- Select the payment method the client wishes to use from the list and click the Record Payment button

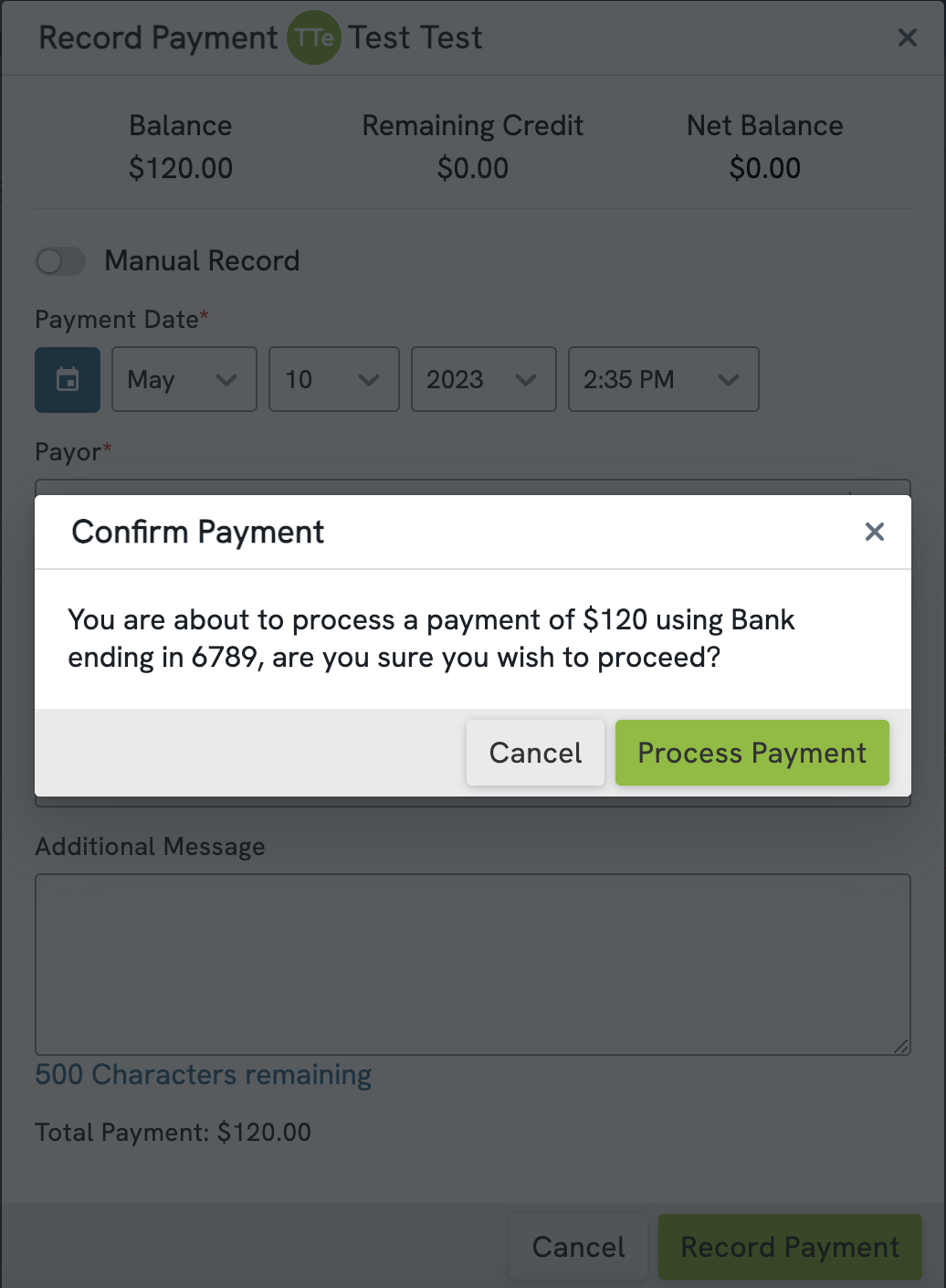

- A prompt will appear showing the the details of the transaction you are about to process so you can review and then confirm the transaction:

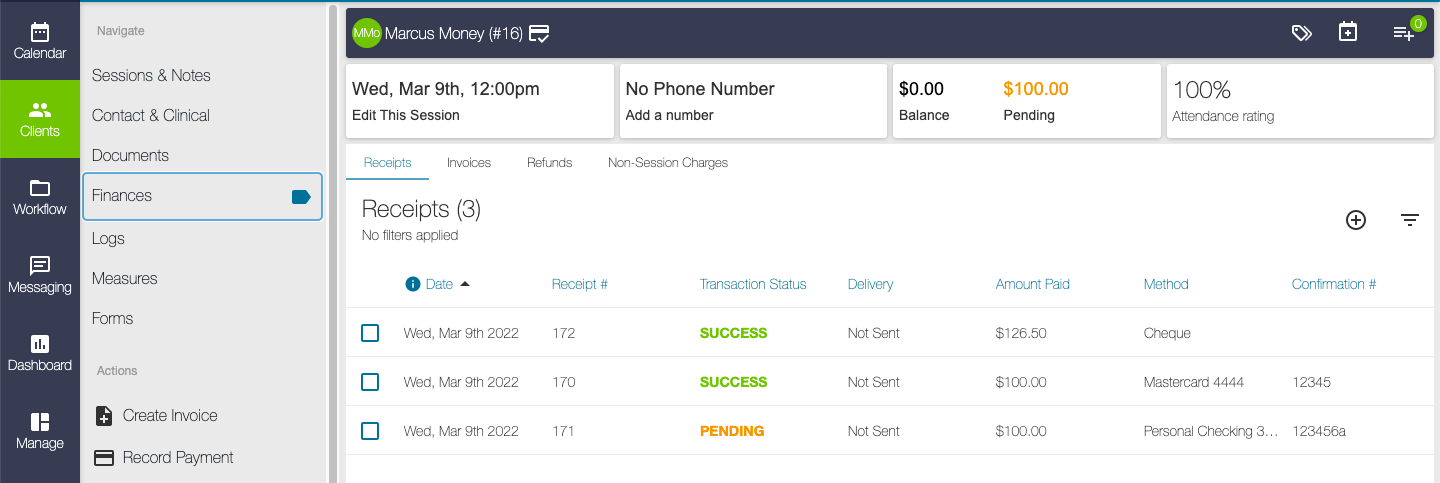

- Once the transaction has been processed, the receipt will be generated and on it you will see the payment method displayed with last 4-digits of the card or account.

You can process payments for the full amount owed or for a partial amount. The amount processed will be accurately reflected on the receipt and the client balance will be updated accordingly.

All of the transactions that you process will be displayed in the client profiles in their individual Finance sections. Each payment will be displayed with a status of Success, Pending, or Failed.

The Success status will be displayed on any transactions that have been processed using Stripe Payments that have gone through the network successfully, or any payments that have been recorded in Owl but processed externally (e.g. e-transfers or checks).

The Pending status will be displayed on any ACH transactions that have been processed through Stripe Payments where the funds have not yet fully settled.

The Failed status will be displayed on any ACH transactions that have been processed through Stripe Payments where the funds could not be routed successfully from end-to-end (e.g. when transactions come back as NSF, or when a chargeback is initiated).

Please Note: ACH transactions do not complete automatically; it takes 3-5 business days to receive a response from the processing partner that the transaction is successful. When that response is received, the transaction status will be updated to Success.

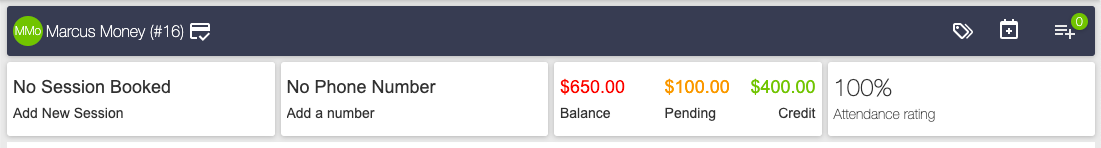

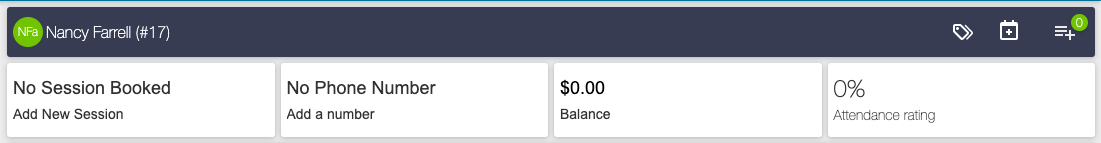

The Client Profile will always display the current balance on file for the client. If there are outstanding payables, the amount will be tabulated and displayed in the Balance section. If there are ACH transactions on file that have not yet fully settled, the amount of those will be tabulated and displayed in the Pending section. If a client has any credit on file, it will be tabulated and displayed in the Credit section.

These fields are updated and displayed automatically in the client profile based on the financial standing with your clinic. A brand new client will appear without a balance on file, so their profile will be displayed simply with a $0.00 balance.

The Balance field will be displayed as $0.00 if there is no balance on file. The Pending and Credit fields will only be displayed with values if the client has financial data on file that matches those criteria.

If a client has a balance owing and you've processed a payment using ACH, the balance on file will not be reduced until the ACH payment has fully settled. In cases like this, you'll see the pending amount of ACH transactions processed and the balance still outstanding. Once the ACH transactions have fully settled the balance owing will be reduced accordingly.